Do Not Emulate

November has been a very profitable month for many Disney believers and investors. After multiple movies hitting all time box office records, continued theme park growth, a surprise earnings beat even though recent acquisitions was expected to bring down balance sheet and the announcement of a surprise 10,000,000 subscribers at launch for Disney+ — Speculation and Hope was high for this stock.

The options and trading community rode high on the Disney move, with over a $16 move in a 30 day period, a lot of people made huge returns, with success and profit posts over much of the social trading community. Large buys were identified for 150 call and 155 calls going into January.

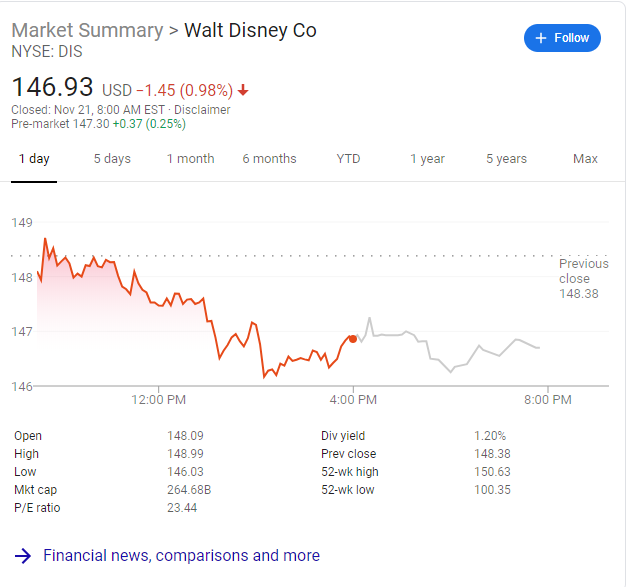

On Wednesday, November 20th, many Disney Bulls had to pull out due to a drastic drop that corresponds with Reuters publishing more “negative” news regarding resolution of the trade war.

Disney lost it’s positive momentum after touching a 149 ATH price point and then plummeting several dollars over the rest of the trading day. This is a disastrous activity for short term options holder with huge losses immediately posting for those who had piled up on cheap options for this “clear winner”

This combination would normally make Disney a great entry point right now – 147.50 has been a clear buy point for the year and we are sitting at 146.93 at market close, this should lead to more buying activity at market open unless the overall fear of market downturn from trade war keeps out investors.

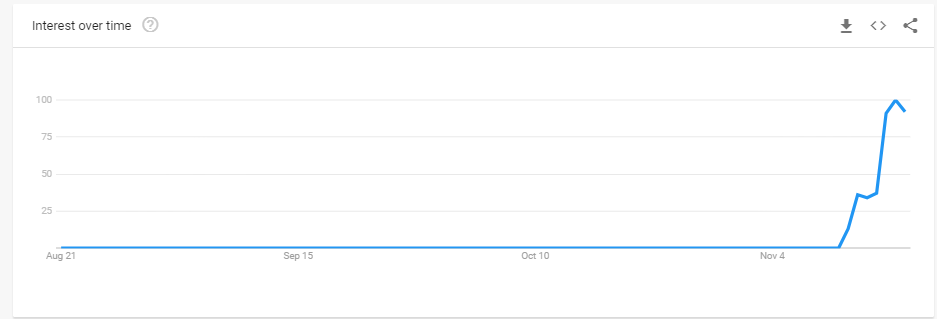

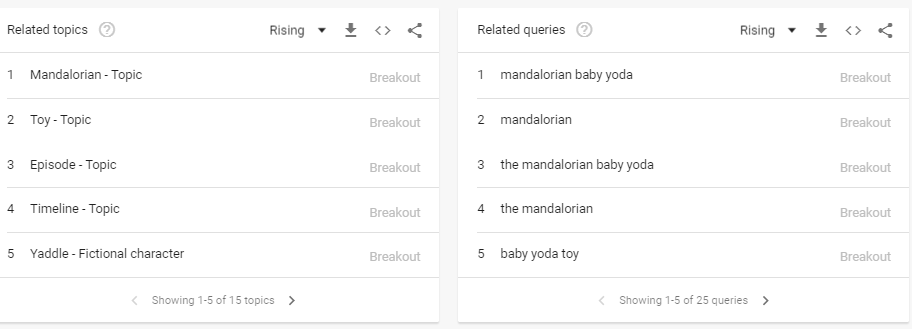

But none of this matters —- Have you seen the the mind-bendingly cute, soon to be legendary introduction of the “Baby Yoda” (he probably isn’t Yoda)

On the creation, launch and impact of Baby Yoda in just the past week, I have liquidated all Berkshire Hathaway holdings in my long term investing portfolio and put in the buy order for Disney.

Why is Disney just beginning it’s rise?

Disney predictions were based on the momentum of the past year and the big success of the movie franchise acquisitions – but Baby Yoda is a new catalyst.

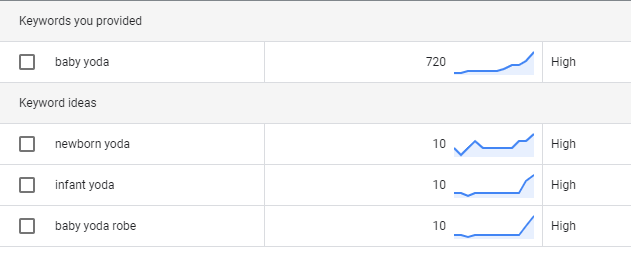

Early measurements of “Baby Yoda” success

Remaining 2019 Catalysts for Disney

- Baby Yoda Memes leading to millions in free promotion for the Mandalorian

- Disney’s initial breakout success with launching a new original series for Disney+ surpassing all projections.

– Analysts predicted adoption based on Disney brand and existing content, creating “Baby Yoda” and all the associated merchandising and new audience members that will be brought to Disney+ and into the Star Wars fandom is unquantifiable – It is going to have massive entertainment and potential across all age groups, from those who love original Yoda to the new adopters that cant get away from the cuteness factor. This is Baby Groot x 1000 - Frozen 2 Numbers will start posting this coming Friday

- Frozen 2 has largest recorded Pre-orders

- Star Wars launches in December – Everyone knew it would be profitable, but with Disney+ introducing and allowing access to Star Wars content to children and the introduction of Baby Yoda in the Mandalorian, this movie will be far more popular than predicted .

- Black Friday Sales

- Christmas Sales

- They fully own Hulu now

You want to bet against Star Wars, Marvel, Disney and Fox at Christmas time plus the new entertainment monopoly they constructed?

Full disclosure – Currently Holding, 147,149,150 and 155 calls extending into Mid January for the highest strikes and expiring after Black Friday for the lowest strikes, currently at -30%

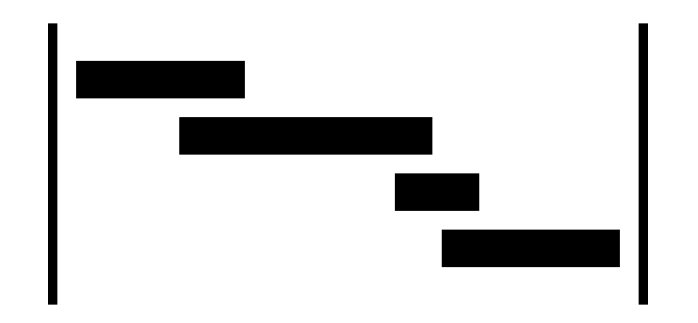

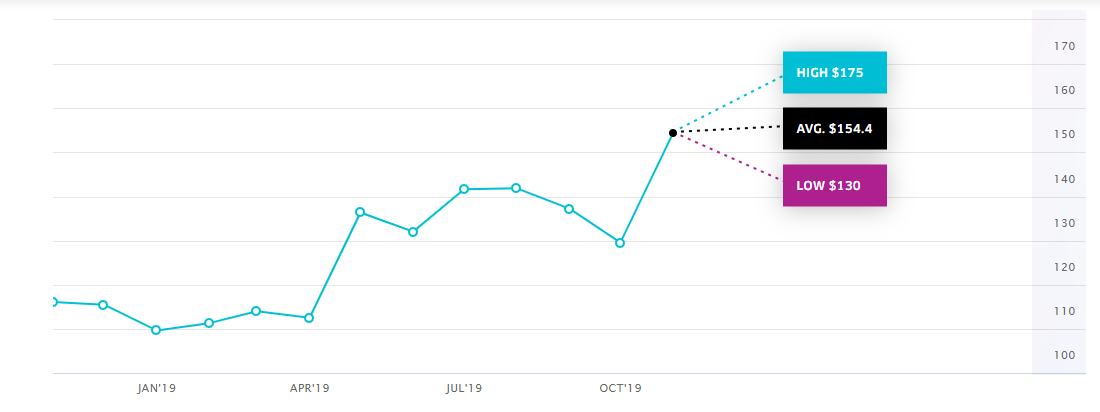

Disney Price Targets

Prior to the Disney+ surprise subscription announcement and the initial fervor around The Mandalorian most Analyst’s had this trajectory and a strong Buy rating

Prior to the Disney+ surprise subscription announcement and the initial fervor around The Mandalorian most Analyst’s had this trajectory and a strong Buy rating

Key Points to watch: 147.50. 152.00, 155.00 with a 2020 cap at 160.00

I think Baby Yoda throws throws those technical points out the window and we see 200 in 2021. Baby Yoda alone is a multi-billion dollar vehicle.

Disney Price Ticker

Disney Buy Alerts

Buy Disney Stock