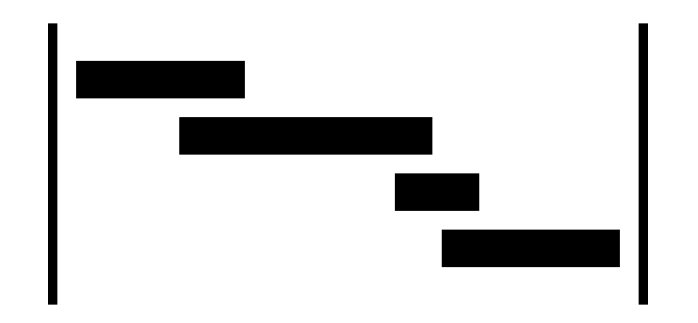

Prediction:

Large sell-offs will occur today, but a hopeful open will make my holdings drop in value quickly

An inverted V will make up the todays activity, giving me an opportunity to further buy into my strategy at a discount

Im keeping my SPY/SPX targets and adding to the position so I have less individual options to monitor

Positive US Futures compared to negative Asian Futures adds support to this belief, but today will choppy and probably scary in regards to holding downtrending options

It might hurt to hold Amazon and will drop it and rebuy midday

Post Bell Update:

Opening Rally MASSACRED holdings – down 9k in unrealized faster than could sell out. This is painful but expected, no time to exit Amazon

Added to SPY January positions and Netflix positions – all puts, buying at discount for the inevitable

Continue to add to SPY positions on the incline, purchased hedge call on SPX

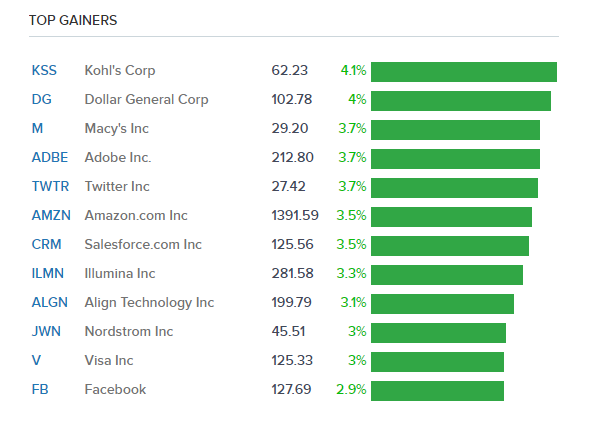

Initial Wishlist

What goes up, must go down – Adobe, Salesforce and Twitter have no solid reason to go green at this time, this spike will be my buy-in on a further 5% decline for both

Now- Im in all the way, still very red for the day (but the accounts overall profits are not even close to loss and wont be) but bought in on the inverted V I expect for the day.

Scary holds for the day:

TSLA,AMZN Puts hemorrhaging on open but will hold until lunch before cutting losses

I believe this will be a red day and a red week and will keep my positions strong.

Wish me luck

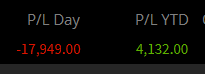

Post Lunch Update

-$16.724 in todays rally, which still doesn’t take out the last 4 days profit, but it’s getting scary.

Im still holding out for this inverted V to be today’s form but wondering if it will truly drop below market open, time value will hurt me on 28th closes, but I dont have many.

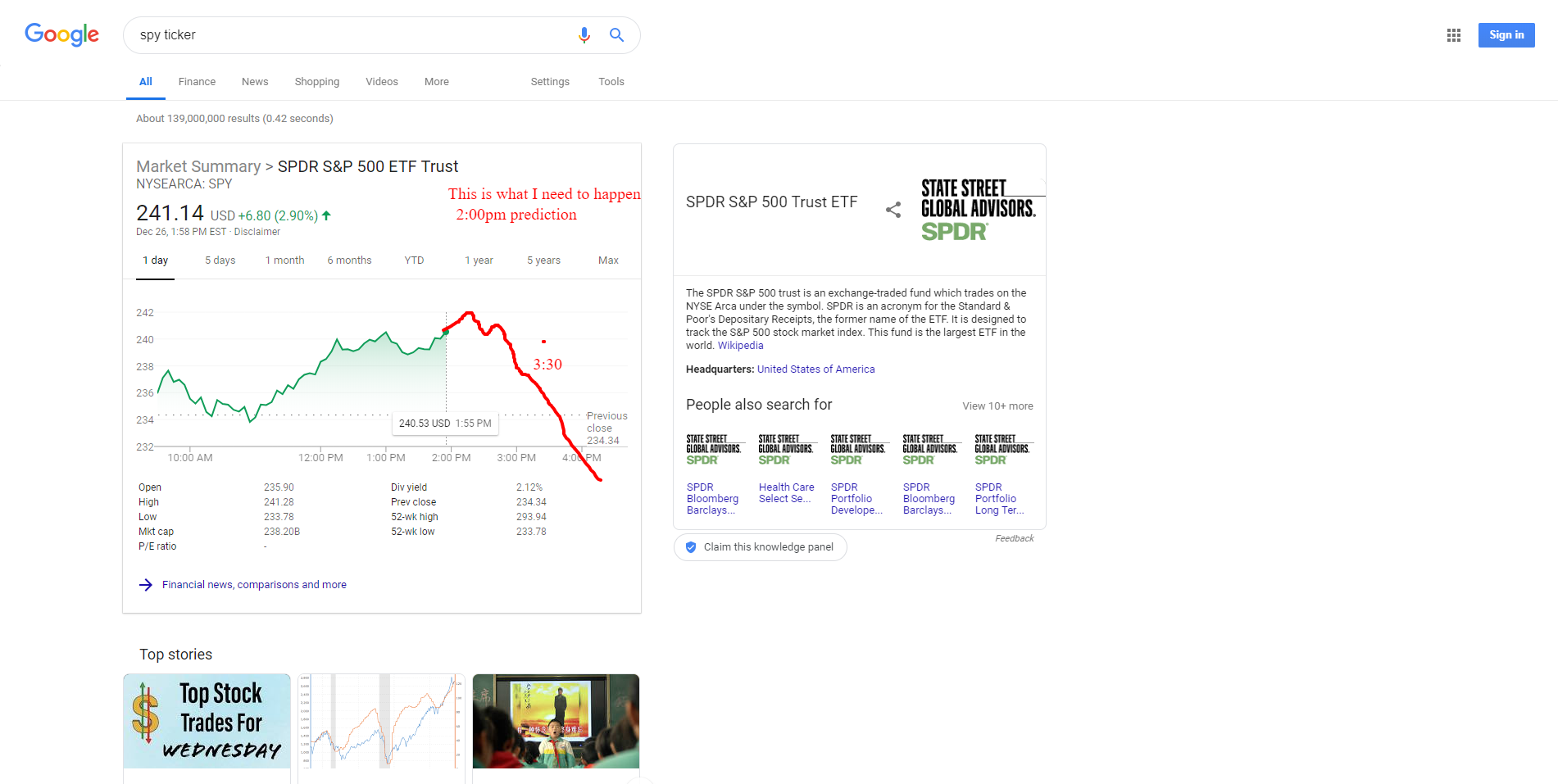

This is what Im hoping for:

More updates:

Getting hard to hold

Now I think the rally will sustain for another hour:

The only update I need for my strategy is I intended to day trade call rallies, that would have worked great today, but I didnt have enough open liquidity to trade with after buying my wishlist items, I also closed by SPX call hedge the moment the first rally ended at a loss, it would have been very profitable if I held. Will make sure that doesnt happen again.

Final Rally Update

The selloff didnt happen. 3:38 and SPY only rising

All YTD Profits (really just one week) wiped out and now at -914

Bought More SPY puts

4:30 Update

I am sad that I didnt take profits when I was at -2k for the day. If I closed all positions I would still be up +18k for the week and could have bought into the rally. Account dropped below day trading limits so will need to add cash(not to trade with) in order to stay above PDT.

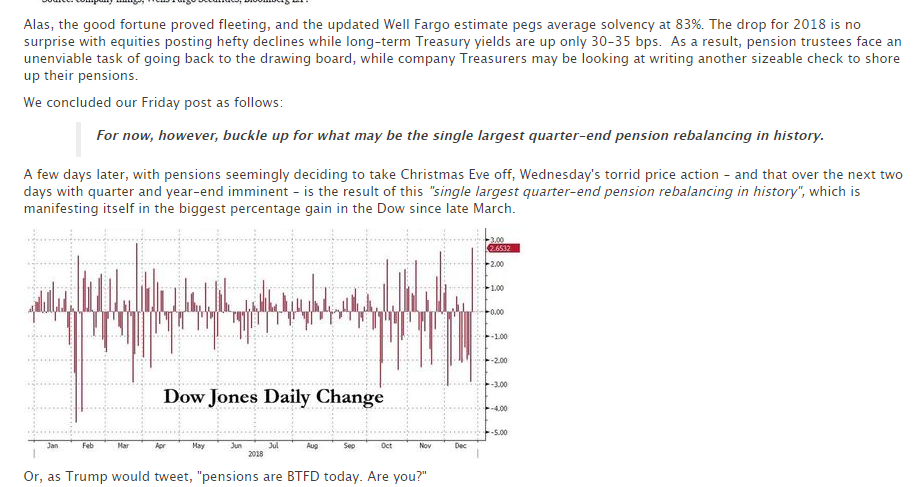

Market likely soared off alogrothmic trading, all time lows for buy in, pension fund buys and gas price decrease. Nothing really great happened on the rest of the world economy and trade war concerns. My holdings are mostly out into January and there is no reason to feel at this time that it cant slingshot back.

Pension Fund Buys far exceeded my understanding of the amount

Lessons learned

1. No Super-priced Options

I am not cut out for Amazons movement. It’s rewards are too high and even when I profit I never enjoy the trade, now Im at a big loss on the one trade and I don’t like it. To much capital in one option contract for my taste. Takes too much focus and can flip spectacularly high to spectacularly low far to quickly.

2. Watch the Dates –

Check pre-market to double down on knowing soon to expire options. Holding so many contracts right now with the majority out into January, I missed an expiring contract that I would have sold to save some returns on SPX, I threw away a bug chunk of change by never even confirming that it wasn’t ending Friday.

I’m sick to my stomach from the big hit and its now hard to be so confident in an eventual decline into January.