Page under revision, documentation of Robinhood issues and interviews with impacted parties pending

Robinhood Account Closed Or Deactivated Without Reason

Robinhood Has No Customer Service or Compensation For Failing To Execute Orders

Who would have ever expected that an online brokerage that targets first time and novice traders would be so completely devoid of support and customer service?

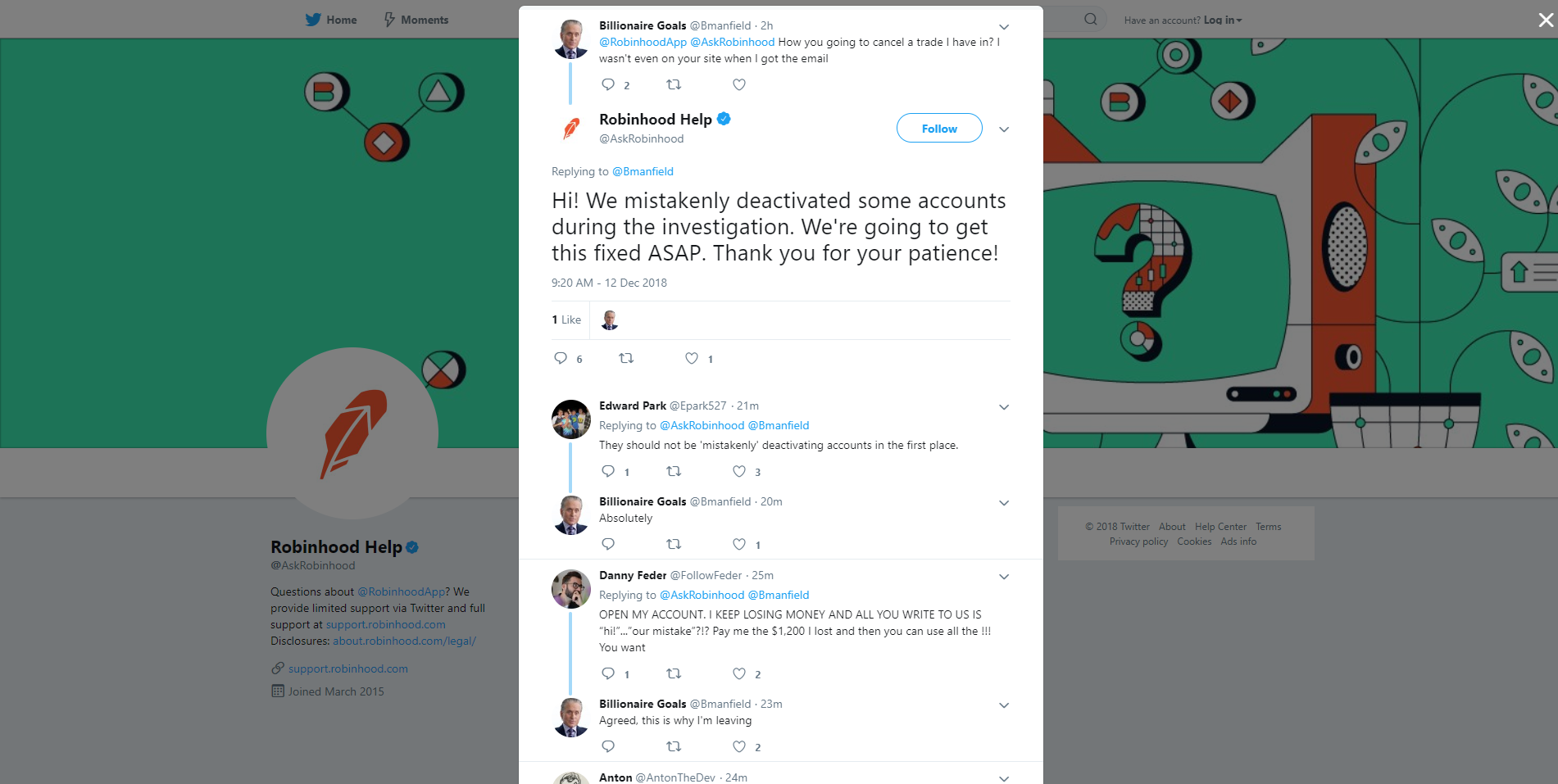

On 12/12/2018, Many Robinhood users were notified in their online accounts that their accounts were closed.

If you were using the web interface it just said “Contact Support” – no link or additional information provided, in the mobile platform a link exists, but leads to a generic FAQ contact system with no direct match to the current problem. The use of “other” allows an email to be sent to support which will trigger an automated response to your email of record.

At no point in over 24 hours has robinhood updated the app with messaging, sent personalized ails or began calling their clients.

Best Options For Switching From RobinHood

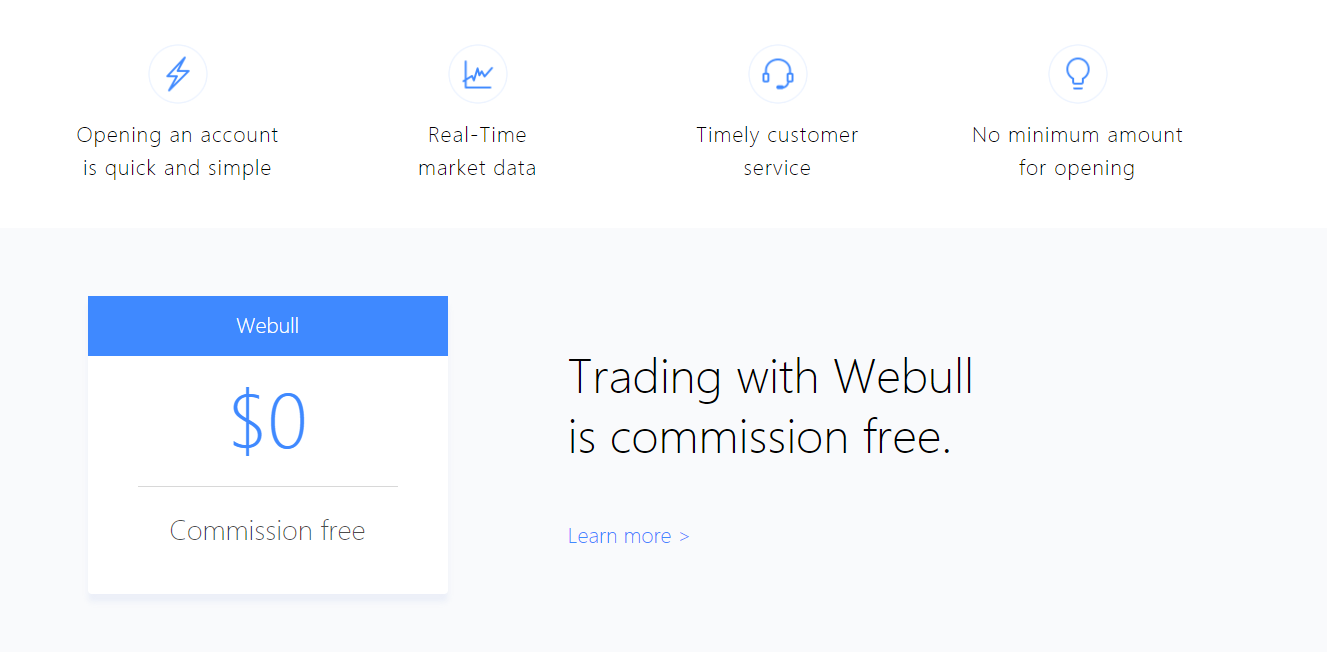

If your trading needs are simple buy and hold, swing trading or day trading, WeBull has commission free trading, actual support staff and they give out free stock for signup bonus with them, just twice as much as Robinhood. Once when you signup and once when you fund your account.

The alerts, education and intelligence tools far exceed any offerings at Robinhood. The interface is more traditional but the “simple” robinhood interface lacks common trading features and appropriate safety measures.

But most locked out accounts are probably more active options traders and WeBull does NOT offer options. Tastyworks below is the lowest fee, highest featured options trading platform available currently.

No Fee Trading from Webull

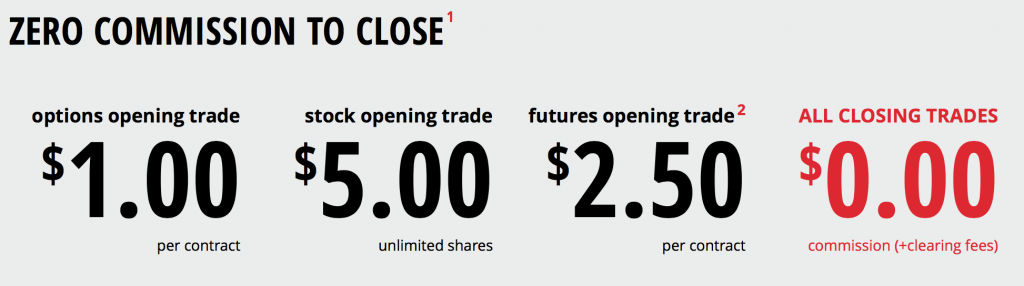

Full featured option trading with lowest fees and modern interface at Tastyworks

Webull will work for basic swing trading, day trading and holding stocks for long term growth, commission free but does not offer options yet.

Tastyworkshas a proven product and a very slick easy to use options interface. They offer immediate funding and have web trading, a fully featured desktop app and a mobile app. This is my main choice for someone used to RobinHoods options trading platform.

See more here: Tastyworks

Advanced Option Trading Far Better Than RobinHood

One good thing about the Robinhood meltdown that made me feel better is that I was forced to jump into my tastyworks account to try and make up for the hemorrhaging from my options holdings. I use(d) robinhood, webull, think or swim, motif, m1, acorns and was an occasional user of tastyworks, but the process of moving funds out of any one account had never been pressing before.

How To Switch Accounts From RobinHood to a Better Broker

So far the only offer I have seen from Robinhood to impacted users has been an offer for 3 months of free robinhood gold. What a terrible idea … take more margin from a “brokerage” that closes down accounts and has no customer service, that will end well!

I suggest that all who choose to leave, and according to the Facebook groups, reddit groups and twitter chatter, that number is very high…demand that all fees for leaving or transferring funds are waived and covered on both directions.

Can I Sue RobinHood for Negligence or Fraud

The first response many would have in a situation where outright negligence is so rampant is to consider legal compensation. But as obvious as the negligence and lack of personal obligation robinhood and it’s ownership are showing during this crisis is – pursuing a broker for technical errors is a difficult and likely fruitless action without class action. A more likely action is to pursue SEC and FINRA violations, of which the links are provided in a later section of this page.

RobinHood Class Action Suit Interest

Online brokerages place protective clauses in their user agreements when you sign-up. For small concerns, this likely gives them all the protection they need.

You may not be aware that “real brokerages” actually compensate their clients when a mistake occurs that is the broker’s error.

But, small technical glitches and hours and hours of downtime are different things and Robinhood is rapidly reaching the territory of massive negligence. They clearly did not have a back up or contingency plan, they did not work all night, they did not offer any customized customer support and they still have not corrected their system lockouts over 20 hours after initial announcement.

“”I consent to the use of automated systems or service bureaus by You and Apex and Your and Apex Clearing Corp.’s affiliates in conjunction with My Account, including, but not limited to, automated order entry and execution, record keeping, reporting and account reconciliation and risk management systems (collectively ‘Automated Systems’). I understand that the use of Automated Systems entails risks, such as interruption or delays of service, errors or omissions in the information provided, system failure and errors in the design or functioning of such Automated Systems (collectively, a ‘System Failure’) that could cause substantial damage, expense or liability to Me. I understand and agree that Indemnified Parties will have no liability whatsoever for any claim, loss, cost, expense, damage or liability of Me arising out of or relating to a System Failure.””

FINRA Guidelines do have a related clause in regards to prohibited conduct

I believe by not offering phone support during a technical meltdown and failing to execute email orders and offer any feedback to their clients they have violated their primary duties as brokers and their licenses should be at risk.

They certainly should not be going public as they have ridiculous amounts of lost profits to make up for to their existing clients, there should be no room for shareholders right now as the ship isnt tight enough to be invested in by anyone with more than $500

They are launching a new debit card product that interacts with your brokerage account — rather than focusing resources on impacted parties

What is Known to Date About RobinHood – Robbing From The Poor Catastrophe

Report RobinHood to the SEC

The SEC allows all members of the public to file a broker complaint electronically. To do so, you will need to use the official Securities and Exchange Commission Investor Complaint Form . This form generally takes between 30 and 90 minutes to complete, and it asks for:

- Basic personal identifying information:

- Background information on your broker;

- A description of the nature of the complaint; and

- A brief accounting of any related legal action that you have already taken.

If you have sustained major investment losses, and you are ready to file an SEC complaint, it is highly recommended that you consult with an experienced investment fraud lawyer who can help you prepare your case.

Report RobinHood to FINRA

Before you proceed:

Contact the firm. Immediately ask your broker about any transactions that you do not authorize with your broker. If the response is not satisfactory, contact the firm’s branch manager or compliance department. If you lose money or the brokers participated in an unauthorized trade made in your account, you should complain in writing. Retain copies of your letter and of all other related correspondence with the brokerage firm.

- Review our Questions to Ask. There can be no assurances that any action taken by FINRA will result in a payment or return of funds or securities to you even where formal disciplinary actions are taken and sanctions imposed. Relying exclusively on the outcome of FINRA’s investigation may close other avenues of redress if you wait too long to proceed. You may wish to review information on FINRA’s Arbitration & Mediation Programs.Report Form for FINRA Violations

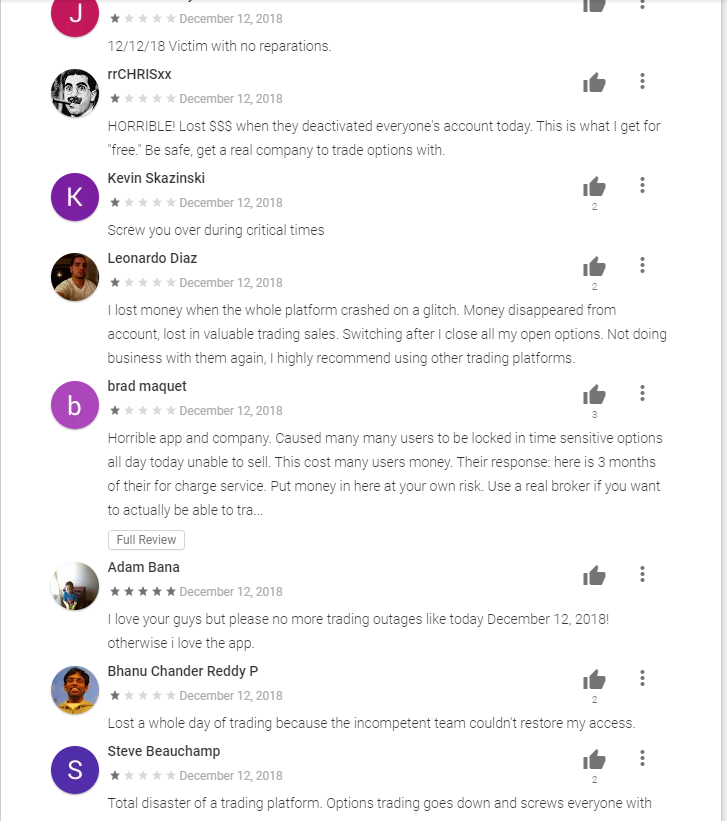

Leave a Review for RobinHood on Android to protect future users

Currently, the Google Play store is not properly documented with the actual customer service and glitches rampant at their service, it is important that the reviews protect future users so they are aware of the unreliable nature of the robinhood product

Review Robinhood on PlayLeave a review on Google for RobinHood to protect future users

Discover contact information of RobinHood staff and Management

Robinhood was founded by Vlad Tenev and Baiju Bhatt

Vice President of Operations is Gretchen Howard

Chief Financial Officer is Jason Warnick

Matthew Kellie is Head of Growth

Nadia Asoya is Head of Accounting

LinkedIn Page for all employees at RobinHood – Since they have no customer service, perhaps individual contacts will assist

I am an investor that was harmed. RH(robinhood) allowed me to continue trading and using their gold account after a deposit failed. I had no knowledge because of the fact their emails went to a email I rarely check and my bank mailed letters so I was uninformed for awhile. But I ended up reading it and figured okay well there still letting me trade and make money so I will just pay margin call. When I paid 7000 call at the time I was reporting to SEC for a option buy that ROBINHOOD sold far prematurely. That was only 100$ at the time. Well I had over 11000 in crypto they could of sold to meet the 7000 call. Well they immediatly deactivated my account and took the rest 5000 from me. The rest after that got worse with lies from their responses to SEC complaints.