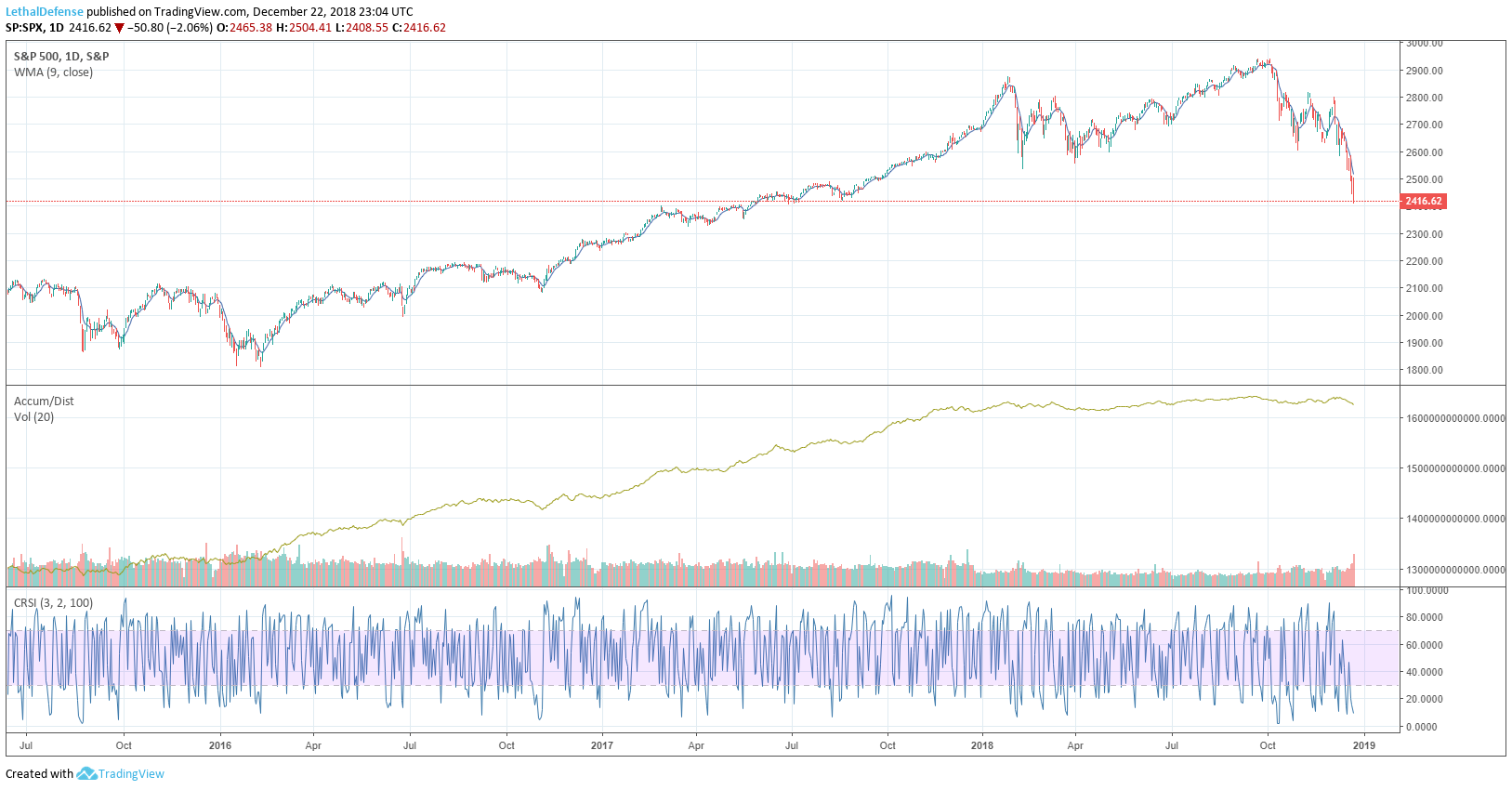

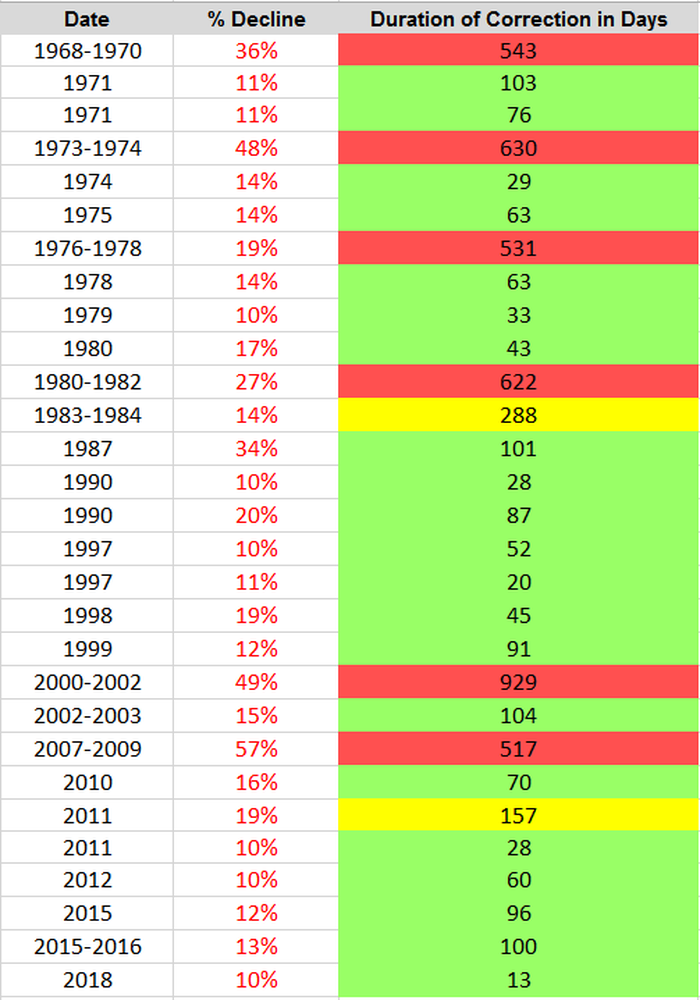

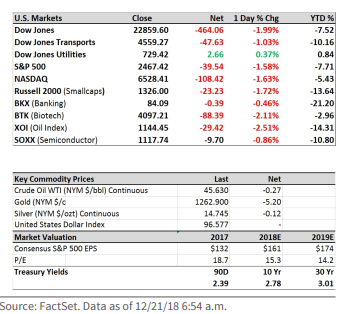

Strategy based on contrarian view that there will be no ‘Santa Rally” and that traditional TA will underpredict any correction as the addition of algorithmic trading and overvalued/oddly valued tech stocks {and “buffet indicator”} plus complete maniac uncertainty in washington suggests a reversion to a much lower new baseline than the average trader would expect.

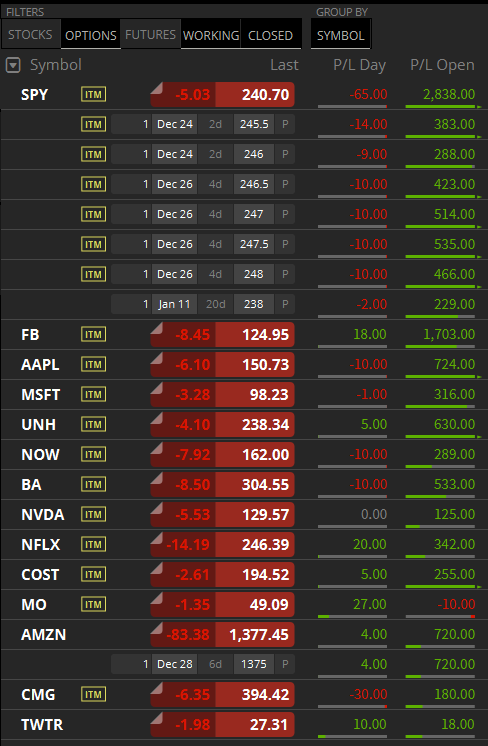

Lacking large capital so taking more risky early moves to gain larger percent increases in order to make larger buys based on a 60 day decline exceeding anything in popular news. This is safe as all puts bought will still be in realistic ranges but will not sell for profit in fear and will be holding to get the lowest lows.

Cryptic Notes

SPY 232.92

SPX 2100

Session 13 in 17-25 average sessions

2460, 2446, 2428, 2417, 2400, 2360, 2360, 2134

Target Buys:

1/4/19 TSLA 315

1/11/19 SPY 237 x 5

1/16/19 SPY 236 x 5

1/11/19 MCD 175

1/11/19 MCD 172.5

1/11/18 NFLX 200

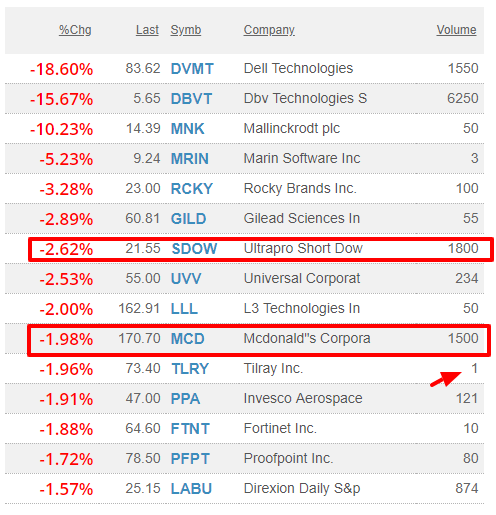

1/18/19 SDOW 24

1/11/19 BABA 128

Supporting Screenshots