Momentum and swing traders should have come across the mention of a “short squeeze” occurring for a ticker they are invested in or researching. This could be a strange concept for a beginner trader, especially one who is more accustomed to investment fundamentals and not the dynamic events that can cause rapid changes to the value of a stock in the short term.

In order to understand a “short squeeze,” one must first understand what it means to “short a stock”

There are much more in depth resources about the risks and rewards of shorting a stock then you will find here, for our purposes we just want to define the scenario.

If you have a strong belief that a certain commodity is over-valued as a company or the stock has reached an unsustainable high based on a news event or even a recent squeeze, then you may see a speculative chance for great rewards in shorting a stock.

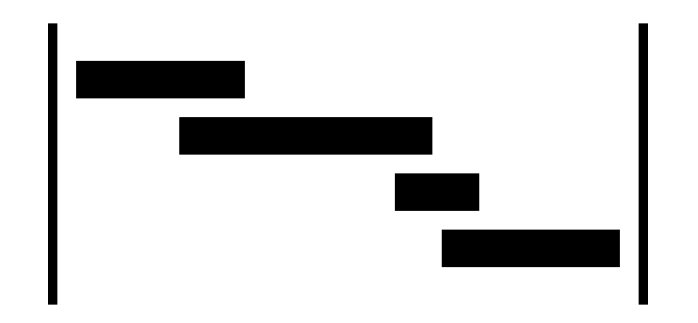

In this strategy you will borrow shares of the stock at the current market price with the plan to buy the shares at a later date at a lower price, should your speculation hold true, you will be able to pocket the difference in the price you borrowed at and the price you purchased at.

The very real risk here, is that should you be wrong in your directional play, you could instead be forced to buy back the stock shares to “cover” what you borrowed. You may do this of your own volition to limit your losses or in many cases be forced to make the purchase at current market prices because of a margin call.

This is where the “short squeeze” comes into play. A heavily shorted stock will result in a glut of orders from traders desperately trying to cover their losses or react to a margin call, as these orders will often come in quickly and in modern trading in an automated manner when a catalyst causes the stock to rise quickly, this increased buying volume will continue to force the price of the stock shares up further amplifying the upward movement of the ticker.

In a bit of irony, if one could effectively “call the top” of this movement, a new opportunity for “shorting the stock” has just presented itself.

In theory, an improperly timed or poorly made decision to short a stock could result in nearly unlimited downside and is not a tactic that should be taken by a novice. A safer and more traditional means for a recreational or beginner trader would be to buy a Put option (BTO) on the stock, this has a defined risk equal to the max cost of the contract and often has equally high opportunities for high rewards.